Will embedded finance cool off in 2023?

Embedded finance has been perhaps the most hyped fintech trend in recent years, with reports of huge untapped market potential driving a surge in companies chasing this opportunity. This momentum was further supported by a historic boom cycle, which saw billions poured into innovative new ventures. Can this momentum keep pace in less favourable conditions?

As macroeconomic conditions grow more challenging, the fintech sector has entered a period of cooling, with a reduced number of new fintech companies being founded, decreased funding activity and a decline in exit deals.

This downturn could suggest a concurrent loss of momentum for embedded finance uptake and innovation. However, there is evidence to suggest that the embedded finance wave is bucking the trend.

Read on: Embedded finance: how retailers & other non-financials are stepping into financial services

The embedded finance opportunity

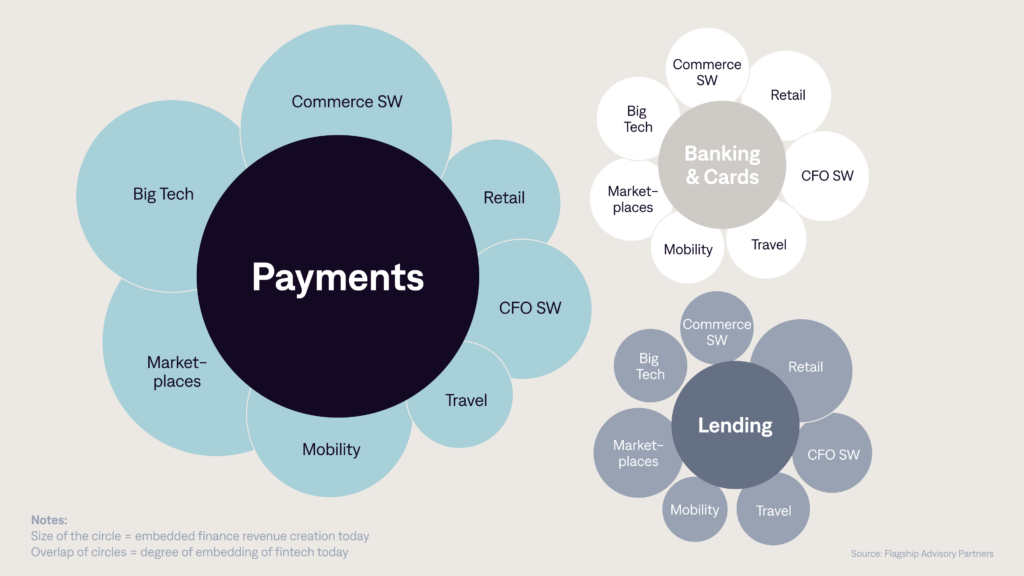

Embedded finance is often cited as one of, if not the major opportunity in banking right now. Currently, the most common use cases are found in payments, with further concepts being explored in banking, cards, and lending.

Reports have suggested that the market cap for embedded finance could reach up to $7.2 trillion by 2030 (at the time of writing, market value sits at $54.3 billion).

Naturally, these projected figures have led to a stampede of businesses chasing the embedded finance opportunity; from banks and fintechs delivering BaaS-type services, to non-financial companies stepping into the world of finance by embedding lending and payment opportunities at the point of sale.

Companies have seen widespread success thanks to business models leveraging embedded finance (think Klarna’s BNPL and Uber’s seamless payments), and the revenue and customer acquisition generated by those who get it right has been immense.

Read on: How a greenfield approach puts banks at the centre of embedded finance

Embedded finance projects struggle

With that being said, a regulatory lens is now shining on the embedded finance industry which, coupled with challenging macroeconomic conditions, threatens to dampen the momentum of this trend. Stories such as the sale of UK fintech Railsr, and Goldman Sachs’ Platform Solutions losses, paint a bleak picture, but it is perhaps too soon to make any sweeping predictions.

Goldman Sachs’ Platform Solutions: a cautionary tale?

Banking giant Goldman Sachs recently announced that its Platform Solutions arm, set up to support co-brand programs and embedded finance, is making massive losses. This project was started by Goldman as a way to drive more predictable revenue; has something gone wrong? Or should we be focusing on the bigger picture?

Despite the losses, the revenues for Goldman’s Platform Solutions arm have grown significantly: a 135% YOY increase. The pace at which Platform Solutions’ revenue is growing also far outstrips the pace at which losses have increased. Perhaps this means that, rather than being a failed project, Platform Solutions is simply in an awkward growth stage.

Goldman has certainly entered a challenging period, and difficult decisions will need to be made. We will likely see certain business lines being cut as the unit reorients, but Goldman has built a solid foundation, and embedded finance represents possibly the biggest opportunity under the Platform Solutions umbrella. The strategy is sound, whether it can be properly executed remains to be seen.

Towards an embedded future

Adverse macroeconomic conditions can certainly constrain the pace of innovation, but the trend of embedded finance is proving to be resilient. In fact, we expect embedded finance use cases to continuously progress throughout 2023. The biggest shift will be from transactional embedded finance (integrated payments, BNPL) to relational i.e. financial services that cover an ongoing relationship, for example, mortgage and insurance products for home buyers.

More complex use cases will, of course, require buy-in from players along the entire value chain. Chasing these potential revenues may even incur temporary losses, but those who execute a well-thought-out embedded finance strategy stand to make significant long-term gains.

As with many emerging segments, patience will be required. The market share and revenue potential for embedded finance is undoubtedly still there, it may simply take time to materialise.