By Edgardo Torres-Caballero, CRO at Tuum

It was 2015 when the European Union introduced the revised Payment Services Directive (PSD2), which was the first piece of legislation aimed at opening up banking, or to use the directive’s parlance, to “level the playing field” for new banking and payment players. Today, more than 50 jurisdictions from Australia to Mexico have implemented similar legislation – with the US looking likely to act soon, too.

So, 9 years since its advent, how is open banking doing? Is it levelling the playing field with positive outcomes for innovation and customers? This was the topic for a lively discussion we had at the Seamless Europe conference in Berlin, which I attempt to summarise below.

How open banking works

Open banking facilitates data sharing between traditional banks and emerging fintech entities. As such, it breaks down the data monopoly traditionally enjoyed by large financial institutions. Where a customer gives their consent, third-party providers (TPPs) can access customer transactional information or initiate payments on their behalf, without having to be fully licensed banks or payment companies.

This is actually more radical than it seems, because it takes away agency from banks and gives it to consumers.

If we think about another industry, say hotels, if a hotel puts its rooms on an aggregation site like booking.com, that is their choice. Under open banking, if a customer chooses to share their information with a TPP, a bank has no choice but to oblige, even though that gives away critical inventory.

How open banking levels the playing field

Open banking fosters competition in a number of ways, such as:

- Opening up distribution of financial services, by allowing many other actors to look at customer financial data and be able to direct consumers to relevant products and services

- Better borrower screening or targeting by fintech lenders, thereby promoting competition in the lending market

- Facilitating account to account payments, bypassing existing rails and schemes

- Facilitating the provision of niche products or tools, such as comparison sites or aggregation services

Accelerating embedded finance will be its biggest impact

Banking is becoming more networked. By that, we mean that banking services are being produced and distributed through an ecosystem of providers, as opposed to vertically integrated banking providers. This would have happened anyway thanks to internet technologies, but open banking acts as a catalyst.

We see this more ecosystem-based landscape for banking contribute to innovation and creativity in three ways:

Embedded finance: the distribution of financial services through any customer touchpoint is going to have massive customer benefits. It is more convenient. It reduces shopping-around time. But it also boosts financial inclusion. The biggest issue with financial inclusion is time and cost of assessing people for financial products, on the one side, and financial education, on the other. By understanding customers better, thanks to better data, everyday channels will be able to match consumers better with the services they need, also potentially adapting the form of those products.

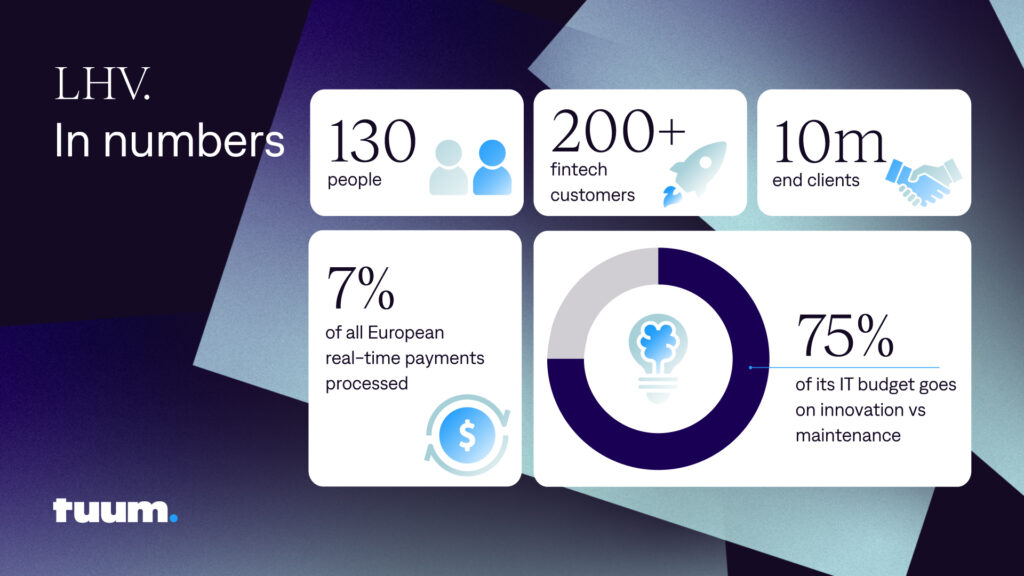

Banking-as-a-service: where regulated financial services providers offer their platform and regulated services as the foundation of an embedded finance ecosystem or to allow fintech firms to get to market quicker with new products and services by building on top of an existing BaaS infrastructure. BaaS is hard to do well because it is complex from both a regulatory and technology point of view, but some players are doing a great job, such as Tuum customer LHV UK, which powers over 200 fintech companies, such as Wise and Coinbase.

Specialisation: increasing specialisation around the existing financial services ecosystem where data sharing can create network effects for all actors, such as in risk scoring or cyber intelligence.

Read the full LHV case study: Freeing itself to innovate quicker

How customers are benefiting

In line with the above, we believe the biggest benefit will be in indirectly improving financial inclusion. By helping up financial services to non-financial channels, which have more data and more touchpoints with consumers, there is an increased probability of offering a consumer the right product at the right time. For instance, by distributing financial services through cloud accounting packages or vertical SaaS platforms, a firm has a higher probability of getting the right service (say a FX forward or an equipment finance loan) when they need it than identifying the need themselves (which may not happen) and applying to a bank (which suffers from a lot of information asymmetry).

In addition, there are other more generalised benefits:

More personalized experiences: since open banking facilitates secure data sharing, enabling third-party providers and banks to develop tailored financial products and services based on individual customer profiles and preferences, it enhances the personalization of the banking experience. Furthermore, in an embedded finance set up, everyday channels can enrich the contextual data they hold with transactional, for even better targeting.

Enhanced Accessibility and Convenience: By integrating banking APIs with third-party applications, open banking offers customers a centralized platform to manage their finances, make transactions, and access a variety of financial services seamlessly, making banking more accessible and convenient.

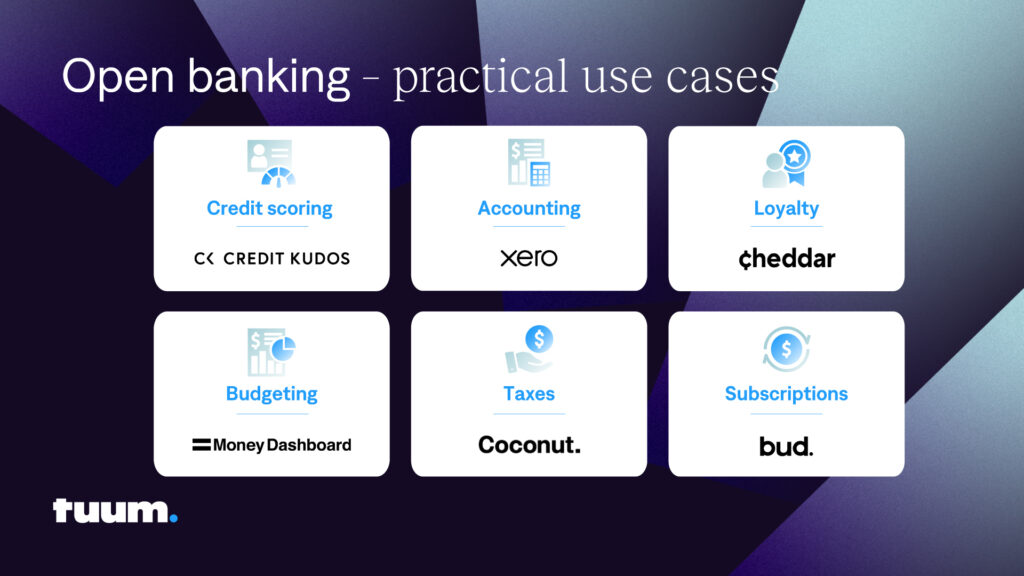

Innovative Banking Solutions: The collaborative ecosystem fostered by open banking encourages innovation, where banks and fintechs co-create new banking solutions like budgeting, tax, and subscription management, thereby enriching the customer experience with more functionality and choice, and saving a lot of time!

How open banking could be better

Open banking is a good start, but it could be better. Here are some thoughts on how open banking could be improved:

- First, in most countries, and which is the case in the EU, open banking mandates data sharing, but it doesn’t say how, i.e. the standards are not set. This leads to a lot of heterogeneity around APIs and standards, which platforms such as Tink are helping to solve, but which hinders effectiveness.

- Second, since cyber breaches could undermine consumer confidence, it could be worth regulators imposing new technology standards over time, such as homomorphic encryption.

- Third, open banking only applies to retail and SME banking. To be more effective, the mandate should extend to private baking, trade finance, and other areas of banking.

- Consumer education: we were all very excited on the panel about open banking, but the average consumer doesn’t know how it can help them. By end of this year, it is estimated that only 10% of EU consumers will have used open banking services.

Would open banking have happened without regulation?

My view is that open banking is and would have happened anyway, without a regulatory push. In the US, for example, companies like Yodlee emerged way before any open banking regulation was ever conceived. And, in private banking, where there is no open banking legislation, players such as Flanks are filling in the gap.

However, that doesn’t mean that regulation doesn’t play an important role. For me, regulation is important in setting security standards (APIs together with strong authentication measures), which are much more secure and introduce further risks for consumer data than screen scraping. Further, the regulators ensure that all stakeholders adhere to the rules, thereby promoting fair competition and innovation. Where the regulator doesn’t perform that role, there is much more risk for companies that rely on open banking providers. See, for example, what’s happening in the US, where Fidelity stopped access to Plaid as it promotes an alternative service, Akoya, in which it is a big investor.

In summary, open banking is nearly a decade old. Most European consumers couldn’t tell you what it is, but it’s already having a tangible impact on consumer welfare, which will multiply when embedded finance becomes more mainstream. So, in short, open banking has done a lot, and we’d miss it if it wasn’t here.

Get in touch to find out more.