By Myles Bertrand, CEO at Tuum

In Marc Andreessen’s recent article on Why AI will save the world, he writes that “Productivity growth throughout the economy will accelerate dramatically, driving economic growth, creation of new industries, creation of new jobs, and wage growth, and resulting in a new era of heightened material prosperity across the planet.”

Now, I am not going to argue that changing infrastructure software in banks is going to have this magnitude of impact. But I do think that, as a former banker reading Marc’s article, there are layers of technology and technical debt within financial institutions that need to be addressed before some of these higher level and higher potential technologies can be truly exploited. To be truly agile in adopting new technologies, banks need to address the legacy software that anchors them and inhibits change. They need to set themselves free.

Opening up possibilities

I remember having a conversation once with a bank CTO at a dinner party. He was showing me his firm’s shiny new mobile app, while lamenting how it was slipping down the list of most downloaded apps on Google Play. When I asked what you could do with the app, the reasons soon became clear. It looked great, but there were so many things you couldn’t do, so many of the bank’s products that couldn’t be accessed, and so few interactive or data-driven features.

For me, traditional bank mobile apps continue to struggle from sitting on top of legacy infrastructure, which makes them vulnerable to disruption from challenger banks and non-banks with better engagement.

The fact is that looking at the IT infrastructures of many banks is like doing an architectural dig. There are systems that have been built one on top of the other, in different languages, on different databases, with different data schema over decades. Some are well documented, some are not. Some are not documented at all.

The challenges of running this kind of infrastructure are manifold. There are the monetary costs of maintaining all of this ageing software and hardware. There are the risks of something going wrong. There is the time lag and costs of making change (my mortgage rate is several interest rate rises below where it should be because my bank’s legacy systems cannot keep pace). And there is the change you can’t make, like easily plugging large language models into hundreds of siloed databases.

But for me the biggest issue is opportunity cost. Banks spend 80% of their IT budgets on maintaining systems vs. building or buying new ones. Of that, as much as 50% of it goes to maintaining core banking systems.

When people tell me the answer to core banking replacement is more middleware, I tell them that is deferring the problem. And the problem isn’t being able to capitalize on the next big technology, like generative AI, it’s ensuring that you spend enough on innovation to keep up with the market over the longer term.

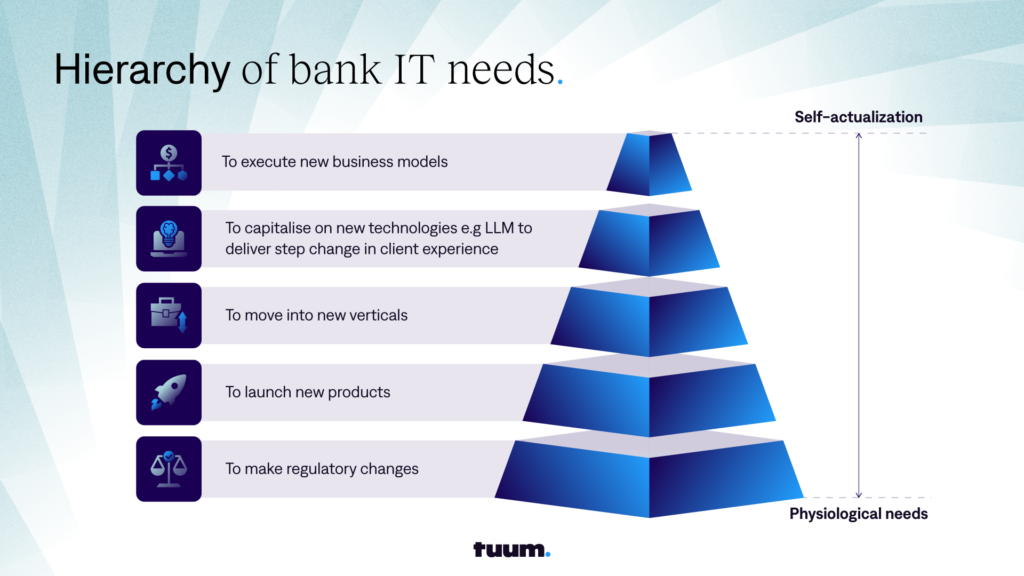

For me, the analogy is Maslow’s hierarchy of needs. If as a bank I want self-actualization, then I need to deal now with some of the base layers like mainframe servers and 40-year core systems.

And, what does self-actualization look like for a bank? It means being free to capitalize on new technologies to deliver better customer experiences, but it also means the freedom to quickly take advantage of new business opportunities, by launching new products, moving into new verticals, and executing on new business models. Core banking replacement is central, particularly to realising new business opportunities quickly.

New business models

Digitization is at a basic level about dematerialising banking products. Removing physical cash. Removing physical distribution outlets. Etc.

But once digitized, new possibilities are opened up.

One is to operate differently. Silverbird, for instance, is a digitally native company. Its view of banking is not encumbered by legacy IT systems and legacy processes. It recognises that SMEs selling digital products operate internationally from day 1. So it helps them to overcome the normal issues they face of having to have a different bank account in every country, to pay and get paid in different currencies, and to cope with FX movements. It sets them free to trade globally.

Another is to have a different sourcing model. The Estonian operations of Nets/Nexi, the European payment processing giant, is a good example. Their focus is on customer success, translating into low customer acquisition costs and high retention, and to make this happen, they are prepared to share revenues, using APIs to easily source services from third-parties, including Tuum, and presenting these as an integral part of their offering.

And the last is to have a different distribution model. Januar is not a household name, it is a supplier to the supplier. It provides banking and payment services to companies in the crypto space, enabling them to accept monies and make payouts. But in this model, it doesn’t have to acquire customers directly, but only indirectly through its partners, lowering its cost of customer acquisition and spreading its costs over much larger volumes of business, boosting margins.

Smart migrations and business builder

Why don’t more banks change systems? The biggest reason is that they don’t want to take the risk of changing core systems. A core banking replacement takes on average between 4 and 7 years and has a high failure rate. And the other main reason is that they don’t want to be beholden to a third party to control their destiny.

Tuum has elegant solutions to both of these challenges, which was a major factor of why I decided to join the company.

As regards changing systems, Tuum has developed a very comprehensive set of migration tools to expedite change, covering everything from moving customer account data to moving contracts. This coupled with a configuration-first approach to delivery means our average implementation times are 7 months and falling.

As regards giving our clients independence, we have a “business builder,” which gives them an extremely wide and fine-grained set of parameters they can use to maintain autonomy over their business, from account structures and hierarchies to pricing, without having to make or request a single change.

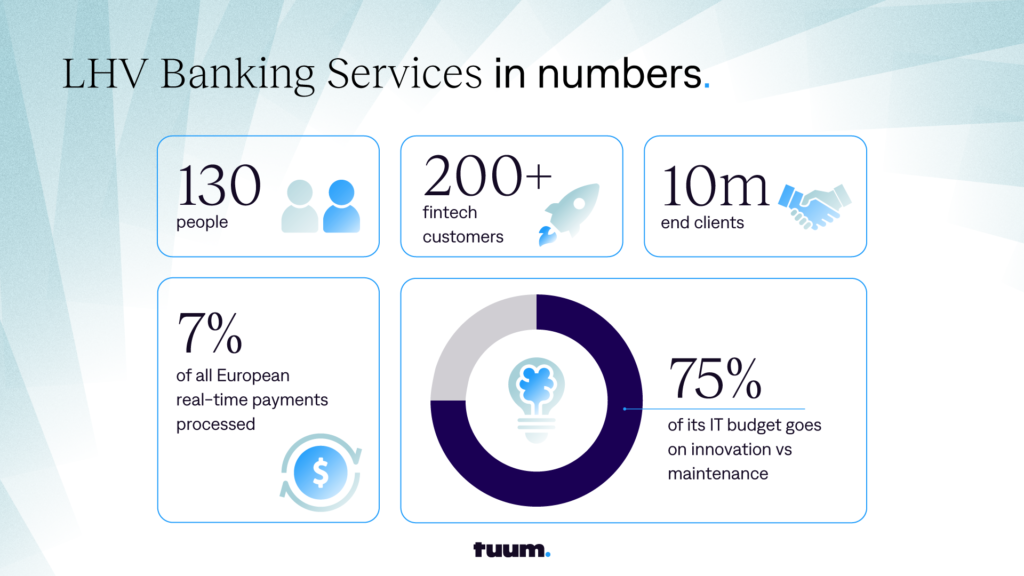

To see these two features working hand in hand, you only need to look at LHV UK. Using our smart migration tools, LHV UK migrated the business of its fintech customers (and 10 million end clients) in under 2 months onto its Tuum platform. It now has 200+ fintechs, each able to operate very different businesses, all running from the same platform, and LHV spends 25% of its IT budget on maintenance compared to 80% at its peers.

Read the case study: Freeing itself to innovate quicker

Fixing the roof while the sun is shining

Why does it make sense to look again at core banking? ChapGPT might be a reason, but there will always be a hot new technology.

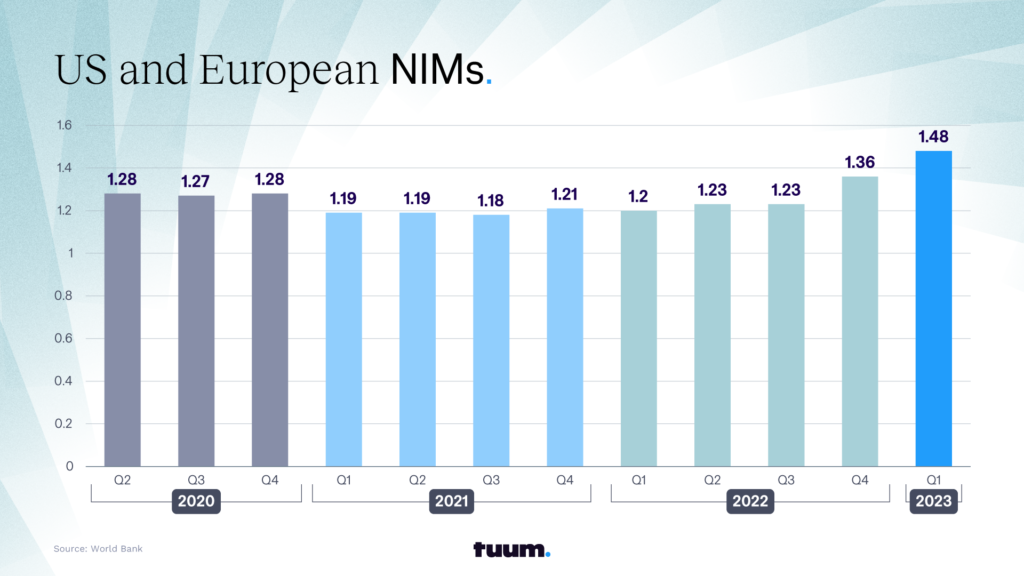

The reason to look at it again now is because Net Interest Margins (NIMs) are on the rise, boosting the profitability of traditional banks with lending businesses. This gives them money to invest in technology renovation. And rather than go straight for the latest fad, they should tackle first the areas of the business where they have the highest technical debt because that is the way that they create the most optionality; open up the widest set of technological and strategic possibilities for their business.

As Warren Buffet once said, “Someone is sitting in the shade because someone planted a tree a long time ago.” It’s time to look at legacy systems now because banks can afford to and because, when they are thriving in 10 or 20 years time, they will be very grateful that they did.

Get in touch to find out more.