Core Banking Digest: Next-Generation Platforms Mitigate Digital Transformation Risk

It’s no secret that digital transformation has been a burning topic for those in the banking industry for a while. Despite widespread awareness of the positive impact a transition to modern banking systems can have, the overwhelmingly risk averse nature of these financial institutions has proven to be a major stumbling block towards achieving true digital transformation.

The advent of a new generation of core banking platform providers has reinvigorated the transformational push. These platforms are more agile, flexible, and scalable than their legacy counterparts; features which make them ideal partners for future-facing financial institutions. Critically, these next-generation core providers also boast tried and tested systems and processes, making them an attractive option for risk-averse banks.

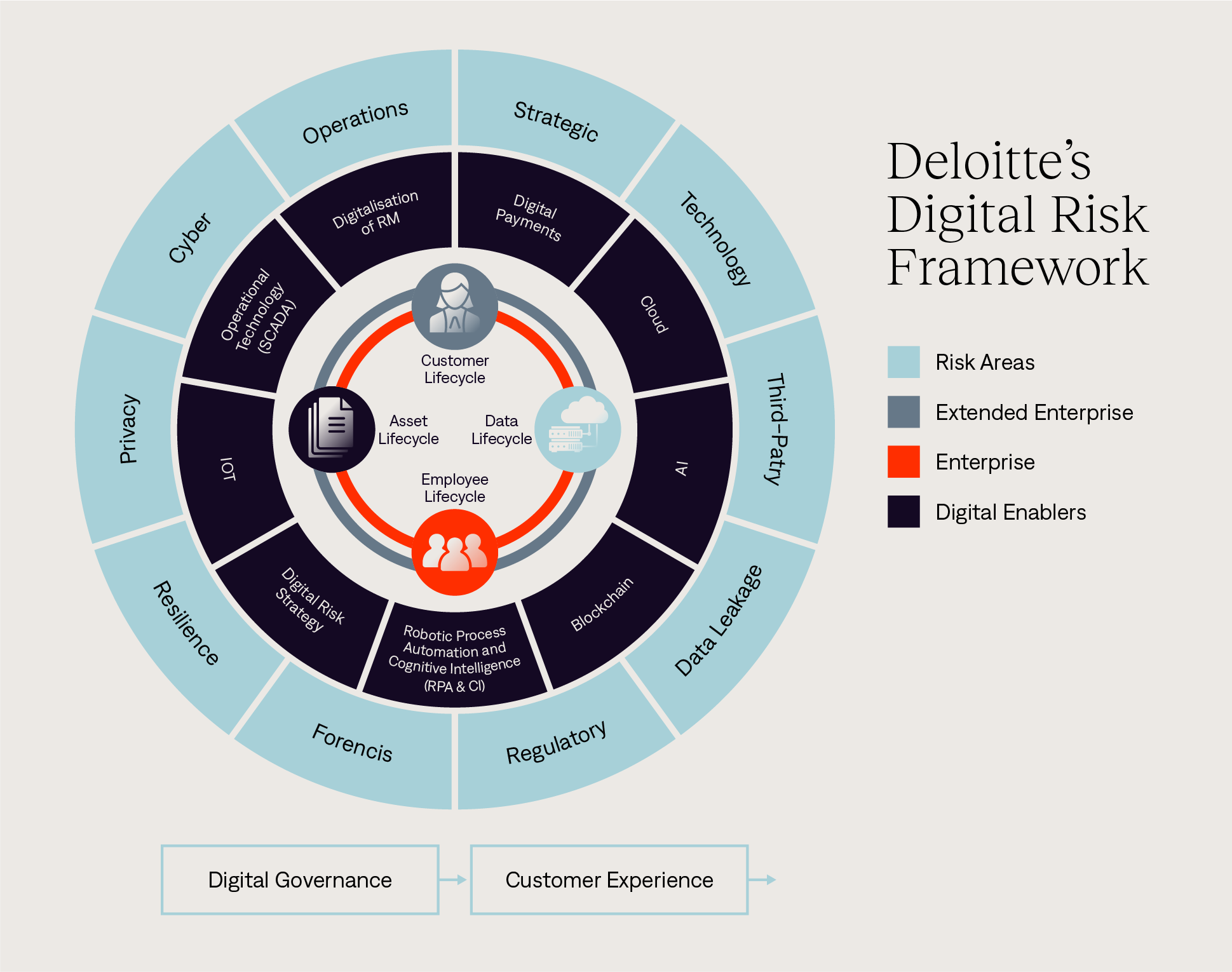

In their report on “Managing Risk in Digital Transformation”, Deloitte outlined 10 risk areas to consider: technology, third-party, cyber, privacy, strategic, forensics, operations, regulatory, data leakage, and resilience. Using these principles, we have outlined how modern core providers effectively address the risk concerns of financial institutions, and how, following a successful digital transformation, these risks can be further mitigated in the future.

Risk Mitigation with Modern Core Banking Platforms

1. Technology

Whilst legacy core systems have typically proven their worth in terms of reliability, they lack the capabilities and open architectures required by modern banking institutions. Additionally, banks must contend with a declining pool of legacy engineering talent and decades of complex and oftentimes undocumented customisation.

How Next-Gen Core Banking Platforms Help

In contrast to legacy systems, next-generation platforms enable rapid product development, real-time transaction processing, frequent feature releases, and flexible scalability. While these platforms are relatively new, they still have the benefit of years of operation, and will typically combine a modern approach alongside the reliability of proven technologies.

2. Third Party

Naturally, any financial institution availing of the services of a third party core provider must feel completely secure in the trustworthiness and reliability of said provider. Operating in an industry as regulated as finance comes with many guard rails, and strict processes need to be in place with regards to data sharing, technology integration, etc.

How Next-Gen Core Banking Platforms Help

Next-generation providers are keenly aware of the controls required of them, and will generally undergo accredited audits (e.g. ISO standards) in order to guarantee their reliability.

Additionally, these providers tend to build API-enabled ecosystems for peripheral functions, such as AML and KYC. These ecosystem partners also undergo rigorous compatibility and integration testing to ensure they meet the standards required to support a financial institution.

3. Cyber

Cyber security in banking is vital to the protection of customer data and assets, and any core banking provider must be able to identify and tackle cyber threats. With the move towards digital banking, these threats have become more pronounced. Fortunately, protection measures have also advanced.

How Next-Gen Core Banking Platforms Help

Modern providers will follow best practices which include; data accesses being logged and audited, databases encrypted, use of bcrypt-hashed password storage, etc., ensuring the integrity of the systems is maintained.

4. Privacy

Core banking providers are privy to much of the customer data of their clients; as such, the importance of proper privacy controls cannot be overstated. Legacy systems have proven secure, but often the data storage is scattered due to their siloed architecture.

How Next-Gen Core Banking Platforms Help

Next-generation platforms have been designed in a way to ensure data is collected and stored in a manner that is both secure and conveniently organised for reporting purposes. For example, sensitive customer data will be stored in just one database whereas other databases only store referencing identifiers. As previously mentioned, these providers tend to undergo audits by accredited institutions which guarantee that employees are abreast of relevant privacy requirements and procedures.

5. Strategic

A core banking system must be able to support the overarching goals and strategy of the institution. Until recently, legacy systems proved adequate; this is no longer the case. Digital transformation has been on the roadmap of incumbent financial institutions for a significant period of time now, and these goals are simply not feasible with antiquated systems in place.

How Next-Gen Platforms Help

Next-generation providers vastly outperform their legacy competitors in this area. Not only do their modern systems support a variety of strategic aims, but the ‘as-a-service’ business model supports a managed service offering with high availability.

6. Forensics

In the event of fraud or security breaches, the need for a thorough investigation is paramount. Legacy systems operate via batch processing and house data in separate silos, which complicates the process of capturing evidence to enable any investigation.

How Next-Gen Platforms Help

Modern core banking systems are designed to continuously stay online, eliminating the need for batch processing windows. This no-batch, no-silo approach ensures that all data is kept up-to-date, in one place, and all payments, applications, etc. are processed as soon as they are submitted. As a result, those operating on a modern core banking platform are best placed to investigate and compile data in cases of fraud or security breach.

7. Operations

Whilst legacy systems have proven adequate and efficient at handling traditional banking transactions, the move towards digital banking in particular has amplified many of the shortcomings of these systems.

These include:

- No real-time backend capabilities

- Complex integrations

- Slow time to market for new products and services

How Next-Gen Core Banking Platforms Help

Moving to a next-generation core banking platform has many operational benefits; improved agility, increased flexibility, to name a few. In this sense, operational risk considerations support moving away from legacy systems which can inhibit the ability of the business to achieve its goals. Resilient tech stacks, regular backups, high availability, and clearly defined disaster recovery processes also ensure any adverse events cause minimal disruption.

8. Regulatory

Regulatory compliance is an area in which legacy systems have shown reliability; they have been in the game for decades and know the ins and outs of applicable laws.

Concerns around regulatory risk are a significant stumbling block in the transformational goals of financial institutions, but successful adopters of modern core systems, such as LHV UK, show that this need not be the case.

How Next-Gen Core Banking Platforms Help

Next-generation platform providers are no longer the new kids on the block, and have demonstrated their reliability and adherence to statutory requirements. With the benefit of having been on the market for a few years now, concerns around trust have been sufficiently allayed.

9. Data Leakage

Across the entire digital system, data must be accounted for and protected through its entire lifecycle, Legacy systems, with their sprawling, siloed architectures, make it much more difficult to adequately analyse data.

How Next-Gen Core Banking Platforms Help

In a modern system, data can be stored at a more granular level, allowing for simple extraction to satisfy all types of reporting requirements. Additionally, data lakes in modern systems facilitate the joining of data from different sources.

10. Resilience

Legacy systems have proven resilient, with few outages reported, which is a factor in many banks’ hesitancy to move away from them. However, the close coupling of these systems means that outages will tend to have a knock-on effect and be more disruptive to business operations.

How Next-Gen Core Banking Platforms Help

The architecture of modern core banking platforms is more loosely coupled than those of their legacy counterparts; different functions work independently whilst still being interoperable with other core functions. This approach ensures optimal resilience, as any disruption knock-on effects are mitigated.

Digital Transformation: A Surgical Approach

To successfully transition to a modern core, banks must be able to manage the risks that are introduced by the transformation process and any effects to the existing ecosystem. This is a large undertaking, but to not move away from legacy core banking systems now represents a significant risk in itself.

By partnering with a next-generation core banking platform, incumbent financial institutions benefit not only from the capabilities of a modern system, but also from the ability to gradually and surgically migrate their different functions, thus avoiding the costly and risk-heavy ‘big bang’ approach.

In doing so, these incumbents position themselves to better fend off market threats and respond to new risks when they arise.

Want to know more about risk mitigation in digital transformation? Get in contact with us.