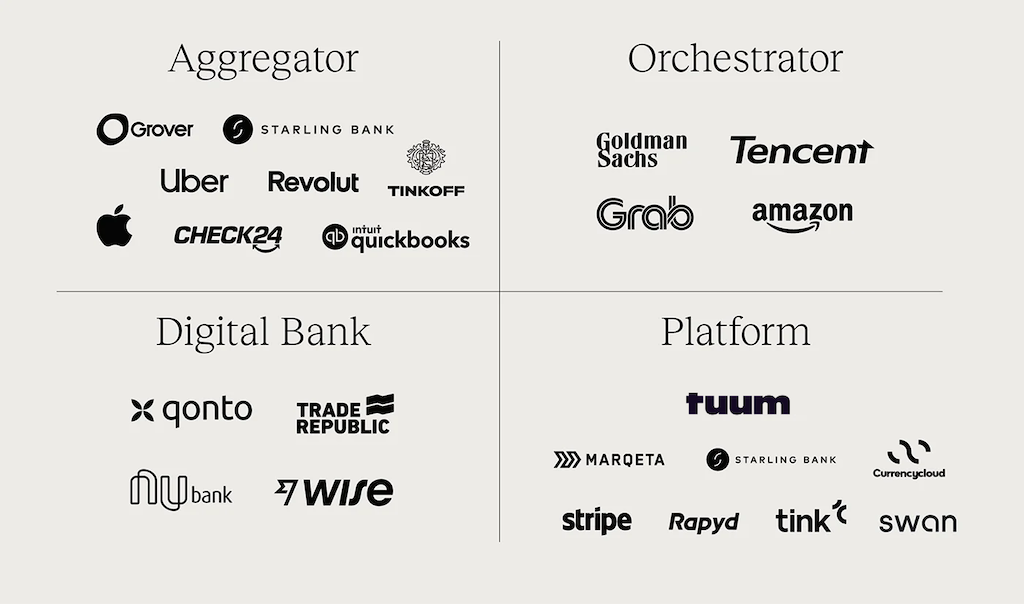

The vendor landscape for technology in financial services has changed dramatically over the past few years, going from a small number of incumbent players to an ever-increasing pool of suppliers. Additionally, the breadth of functions offered by each supplier has become more varied, with some offering a complete full-stack solution and others focusing on very specific niches. This is a positive for financial services providers, as they can now choose suppliers that more closely match their business requirements.

Although the pool of financial technology providers has become a lot more specialised, the processes for selecting a tech provider can still remain unduly blunt. At a time when digital capabilities are business critical, tech procurement must be rethought from the ground up, to ensure the selection results in a tech stack that meets the business requirements of today, and can evolve with the business of tomorrow.

Strategic vendor selection

To reimagine tech procurement for the modern age, vendor selection must become more strategic, which starts with an evaluation of the business models and market segments to line up against.

For the best results, equal weighting must be given to how well the technology aligns with the business strategy, and how seamlessly the technology can be implemented to ensure maximum business impact in the most favourable timeline.

The pitfalls of the RFI/RFP

The RFI/RFP process has traditionally been the way to go when evaluating potential technology suppliers. This is a lengthy process, requiring a great deal of work to capture and document existing requirements from each business unit. With advancements in technology now enabling flexible access to infrastructure, software and processes, there is a better way to do tech procurement.

As argued in our recently published whitepaper; an RFI/RFP-centric approach can lead to a lack of clarity on the full capabilities and suitability of the platform which then only become apparent once gap analysis and implementation has begun. The reason for this is that meaningful interaction between the bank and vendors comes only after responses from selected vendors have been collected and analysed.

Today, suppliers can give access to their systems via a cloud-based sandbox. As a result, processes such as workshops, proof of concepts, MVPs, etc., should be moved up the timeline to give a more accurate picture of the capabilities of the prospective suppliers from the outset, thus avoiding potential function gaps down the line.

Technology must be evolvable

It is a point already mentioned, but one that cannot be laboured enough: the tech stack chosen today should also be capable of meeting the needs of tomorrow. Many financial institutions currently find themselves in a position where their legacy technology is now holding them back, as it is unable to meet consumer demands for seamless, embedded financial services.

Evaluations must consider the extensibility of the technology supplier. If discrepancies in present-day functionality can be quickly addressed, and in future, new capabilities can be quickly implemented, it is a worthwhile investment.

Interoperability must also be considered. With a ‘plug and play’ approach currently taking the financial services sector by storm, financial services companies now have the option of creating an ecosystem of best-of-breed suppliers supported by carefully developed APIs and an open architecture. The ability to curate your own ecosystem can prove to be a major competitive differentiator.

Ultimately, with a reimagined procurement process focusing on strategy and execution, and which favours an early, hands-on approach, financial services companies can develop a tech stack that will shield them from the possibility of ever becoming legacy (again). The right procurement strategy is the first step in future-proofing the business.