Your Pace.

Core Banking

Tuum’s Accounts module powers real-time account, transaction, and pricing operations across currencies and segments—supporting rapid product setup and high-volume processing.

- Account Management API

Manage current, savings, group, multi-currency and virtual accounts with IBANs and account hierarchies. - Transaction Management API

Process real-time credit/debit transactions with configurable types and audit-ready logic. - Pricing Engine

Define custom price lists and automated fee rules by usage, volume, or tier. - Overdraft Capabilities

Support pre-approved or discretionary overdrafts with configurable interest and limits. - Corporate Banking Features

Enable multi-entity setups, intercompany sweeps, and cash pooling. - Deposit Products

Offer fixed, notice, and flexible deposits with automated lifecycle and interest logic. - FX & Currency Management

Handle FX markups, conversions, and multi-currency flows in real time.

Payments

Tuum’s Payments module supports real-time, cross-border, and direct debit payments across SEPA, SWIFT, FX, and local rails—fully integrated with compliance and liquidity controls.

- Payments API

Initiate and validate SEPA, SWIFT, FX, and local payments, including bulk and direct debit. - Processing & Exception Handling

Straight-through processing with fallback to manual resolution. - Smart Routing

Optimize settlement flows across providers with rule-based logic. - Settlement Integrations

Pre-integrated with LHV, Currencycloud, Centrolink, and Banking Circle. - Nostro & Liquidity Management

Track balances and positions across accounts and providers. - Universal Connectivity

Open APIs for connection to third-party processors and orchestration layers. - AML Integration

Automated screening with tools like ComplyAdvantage and Hawk.

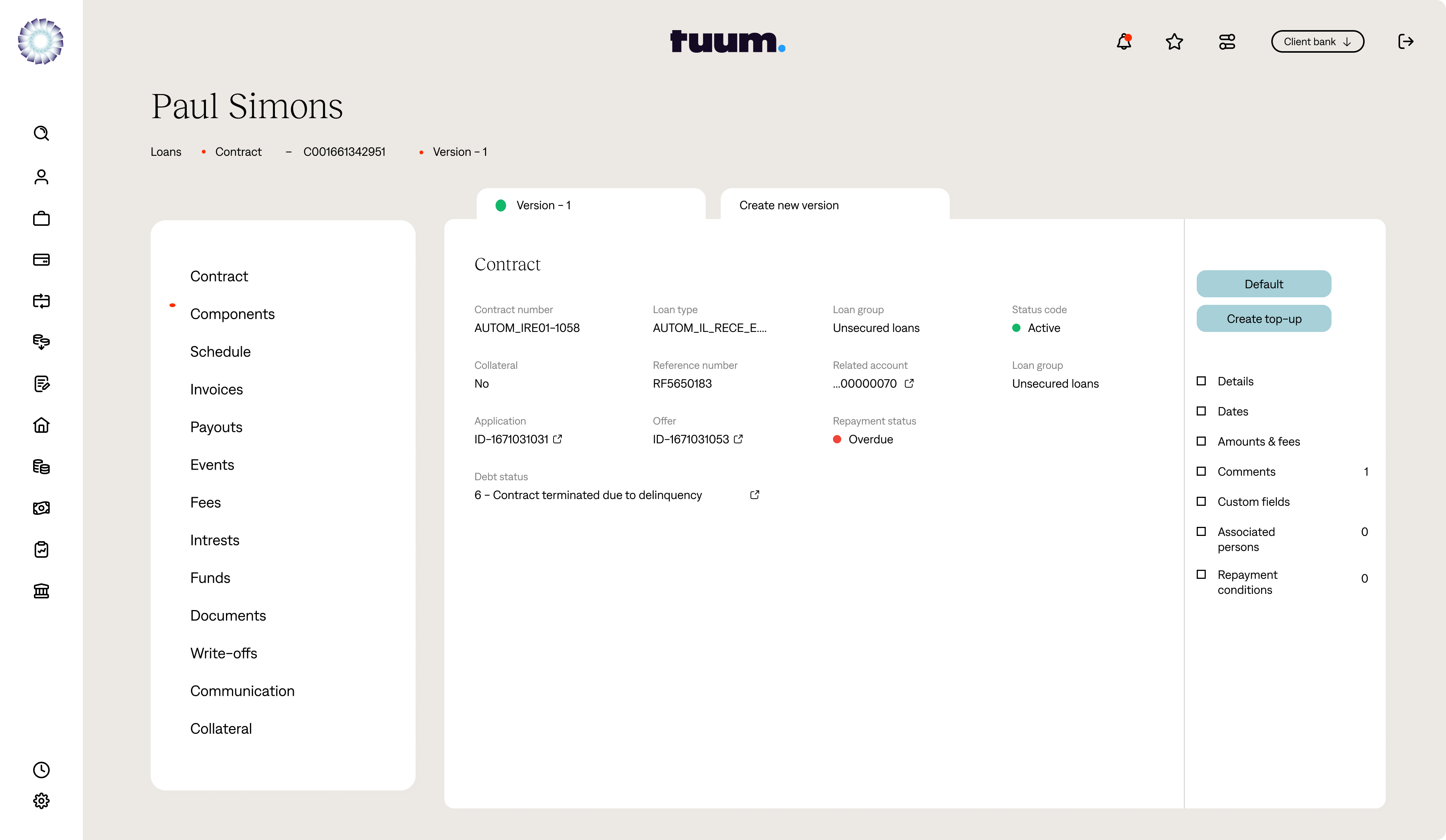

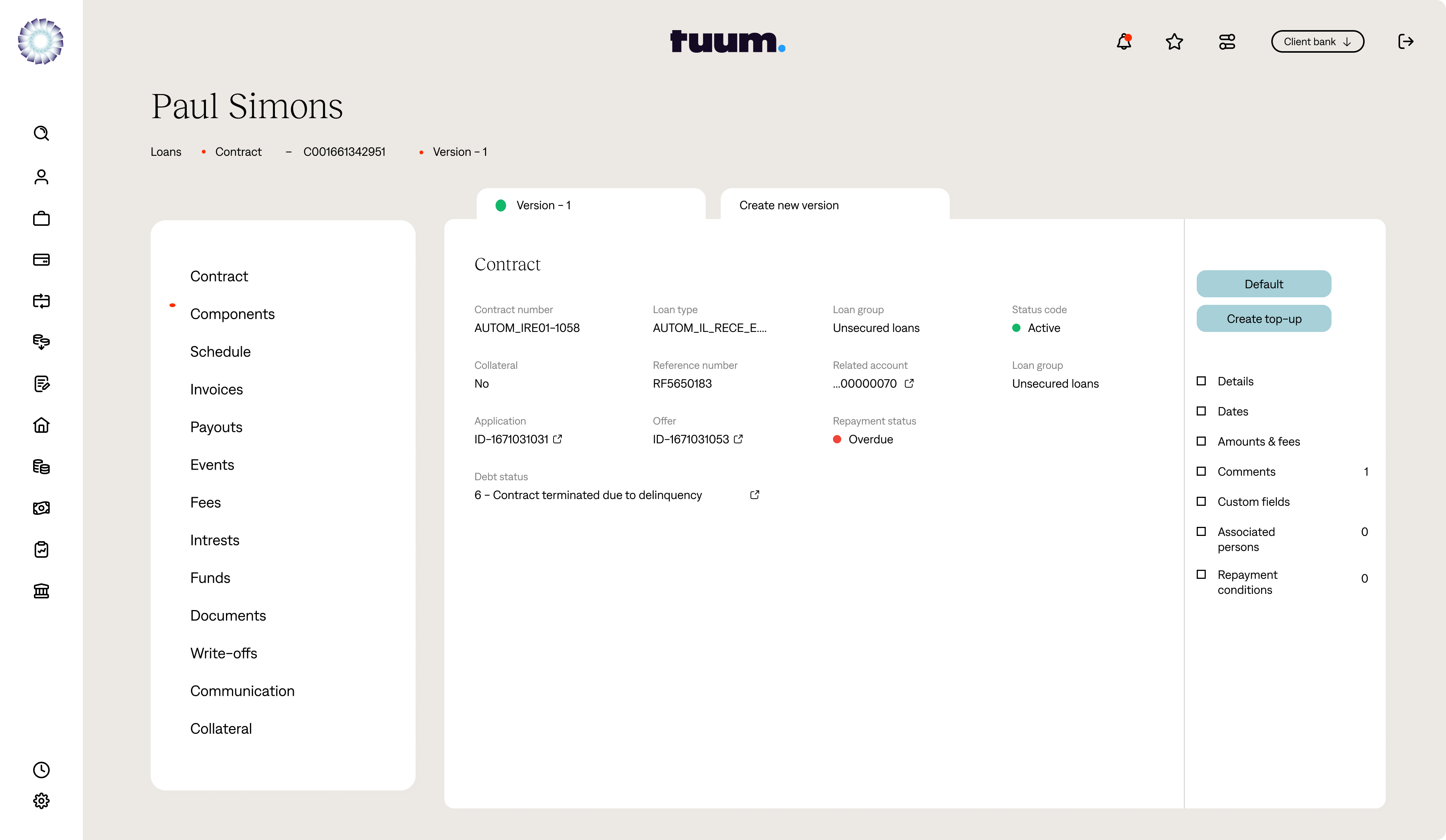

Lending

Tuum’s Lending module supports the full lifecycle of secured and unsecured lending—from origination to collections—with fast product setup, flexible repayment logic, and seamless integration across systems.

- Loan Product Management API

Configure personal, business, auto, and green loans with flexible interest, fees, and pricing. - Loan Application and Offer Generation API

Streamline applications and offers with configurable workflows and campaign support. - Loan Contract Management

Automate servicing from contract setup to invoicing and repayments. - Collateral Management API

Register, track, and manage asset-backed loans and collateral usage. - Debt Management API

Automate overdue tracking and collections workflows. - Corporate Credit Support

Manage umbrella limits and exposures across legal entities. - Seamless Integration

Connect to risk, underwriting, and collections tools via open APIs.

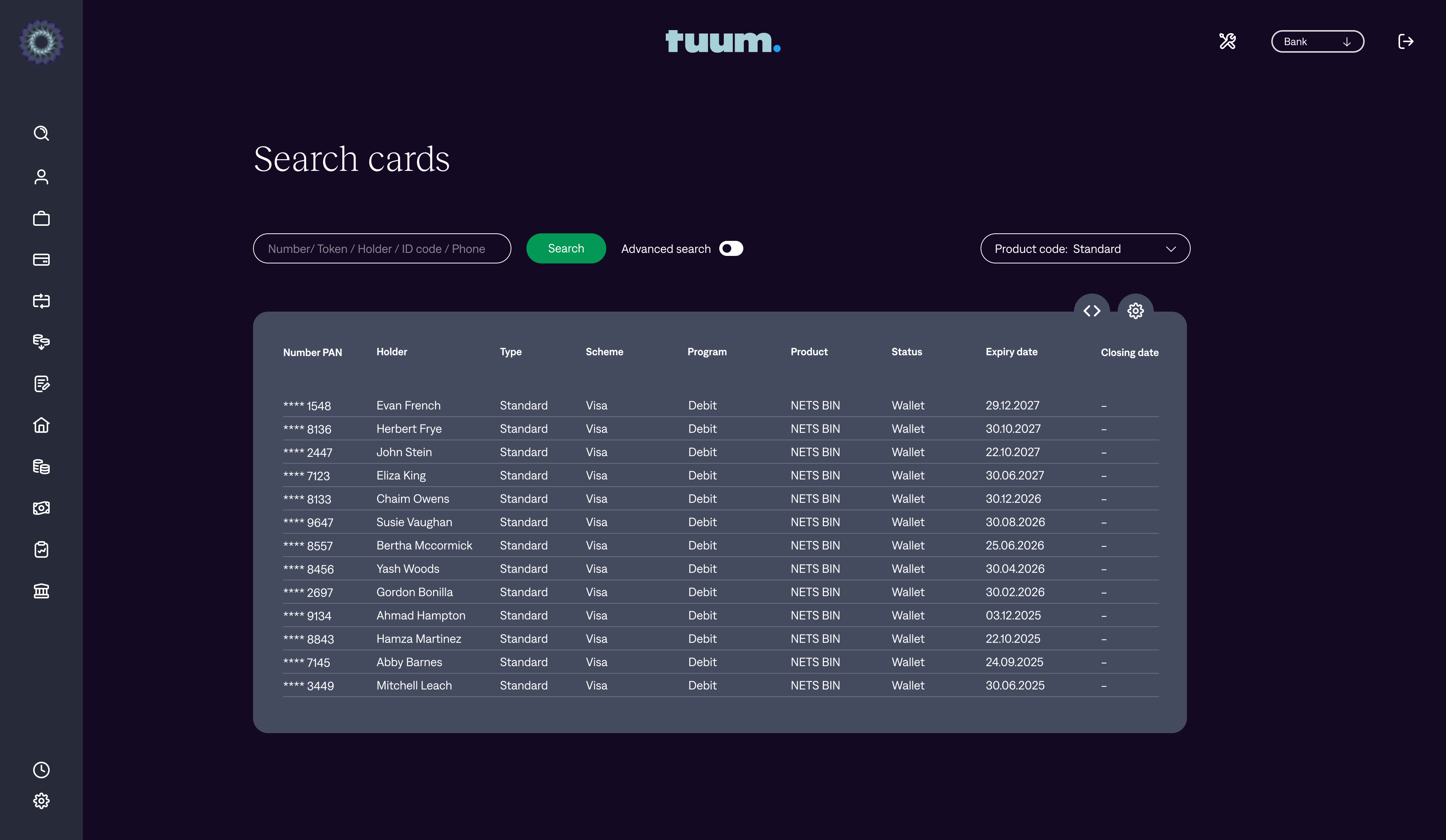

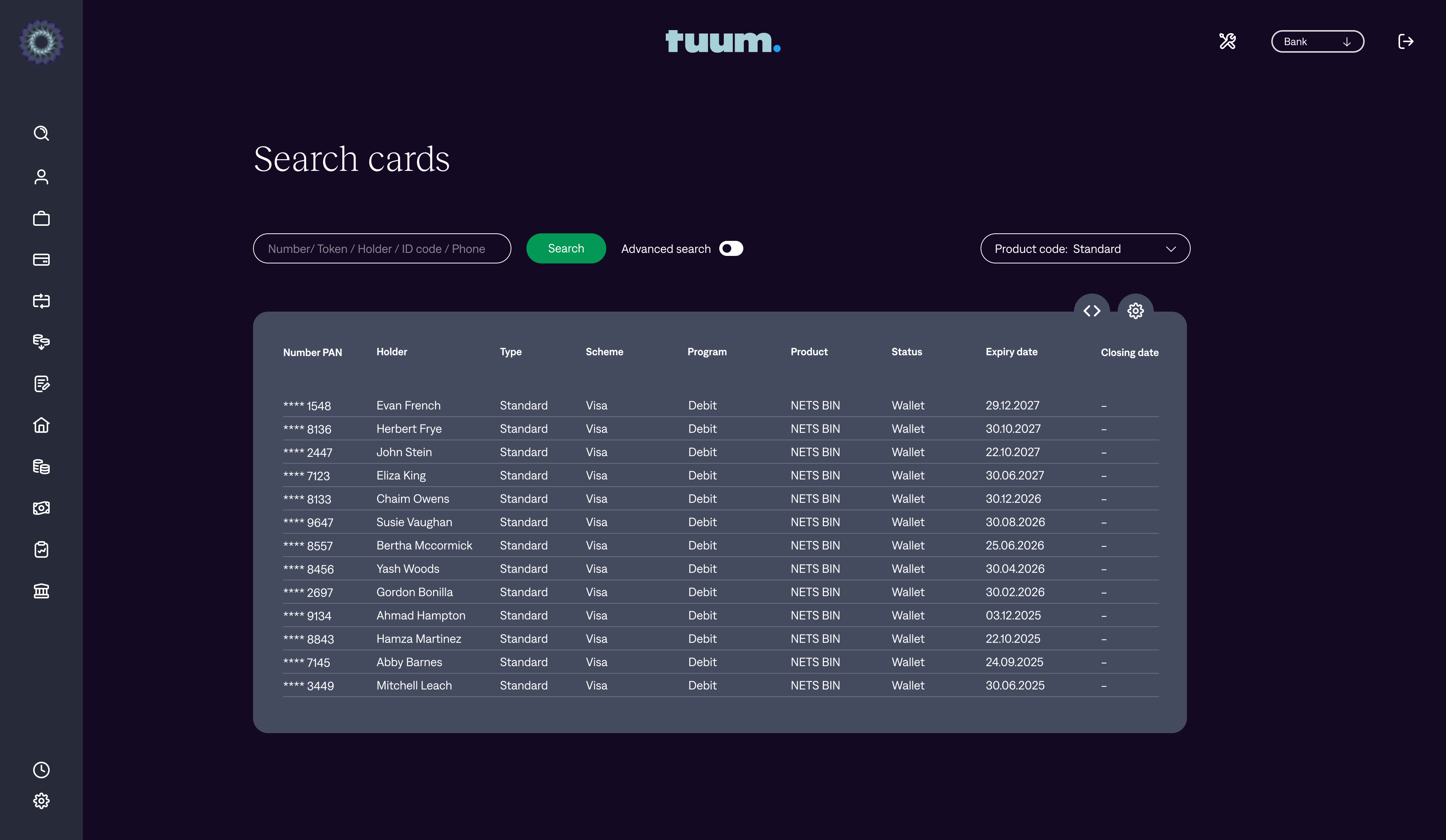

Cards

Tuum’s Cards module enables instant issuing and full lifecycle control for debit, credit, and prepaid cards—supporting digital wallets, fraud controls, and credit contract logic.

- Lifecycle & Issuer Management

Issue, activate, block, and renew cards across schemes and segments. - Transaction Processing & Clearing

Support real-time authorization and clearing file reconciliation. - Pricing & Limits

Set fees and usage limits by product or customer profile. - Fraud & Control Rules

Enforce authorization logic and blocking rules to reduce risk. - Processor Integrations

Connect to Nets, Paymentology, or any external processor. - Credit Contract Management

Support standalone credit card contracts and repayment terms. - Installments & Tokenization

Enable card installments and tokenize Mastercard cards via MDES.

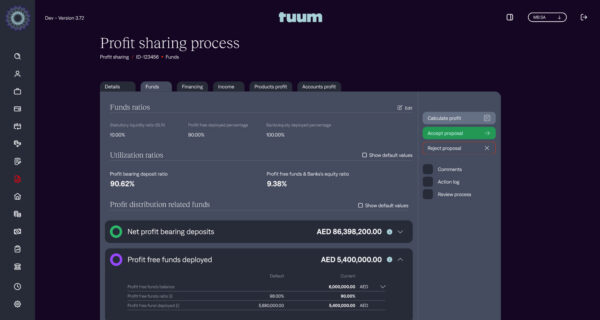

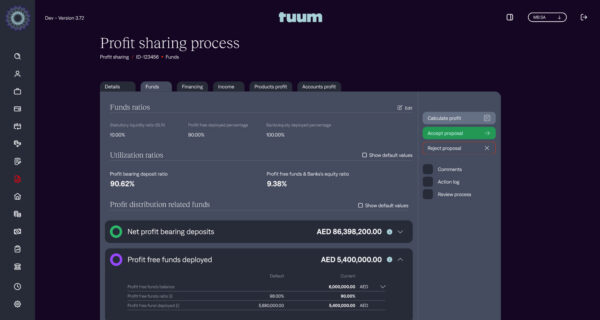

Islamic Banking

Tuum’s Islamic Banking module enables banks to deliver fully Sharia-compliant services—either as standalone Islamic banks or through Islamic windows—while ensuring alignment with AAOIFI standards and seamless integration with core or external systems.

- Islamic and Islamic Window Mode

Deploy as a dedicated Islamic core or operate in parallel with conventional systems to serve multiple segments. - Islamic Accounts & Deposits

Offer account types based on Mudarabah, Wakalah, Wadiah, and Qard Hassan—with automated profit/loss sharing, conditional returns, and full contract lifecycle support. - Profit-Sharing Module

Manage independently or alongside other cores, with full profit distribution logic. - Asset-Backed Finance Module

Support for Sharia-compliant consumer and business financing using the Tawarruq model, with real-time asset trading via integration with DDCAP.

Don’t miss out!

Subscribe to Tuum’s monthly newsletter

Build, expand, and scale with Tuum

Write us a line and find out how to transform your business with us