By: Myles Bertrand – CEO, Tuum

Xtensibility is an industry breakthrough, giving banks strategic autonomy within a cloud framework.

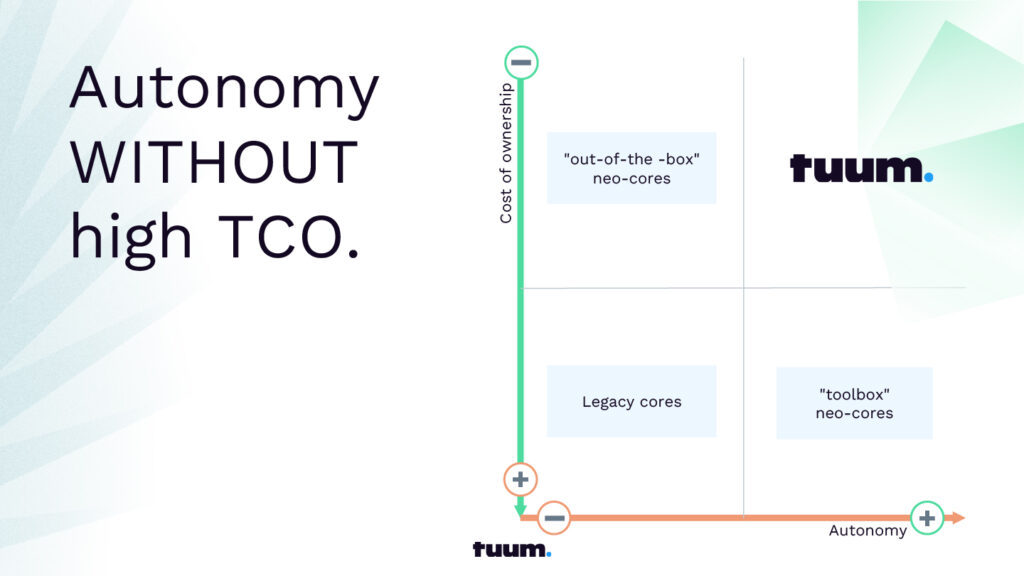

TL; DR Core banking systems have been through several technological generations, becoming quicker and cheaper to deploy. But they still haven’t solved for the trade-off between, on the one hand, low cost of ownership/high vendor dependency and, on the other, high autonomy/high cost of ownership.

Until now…

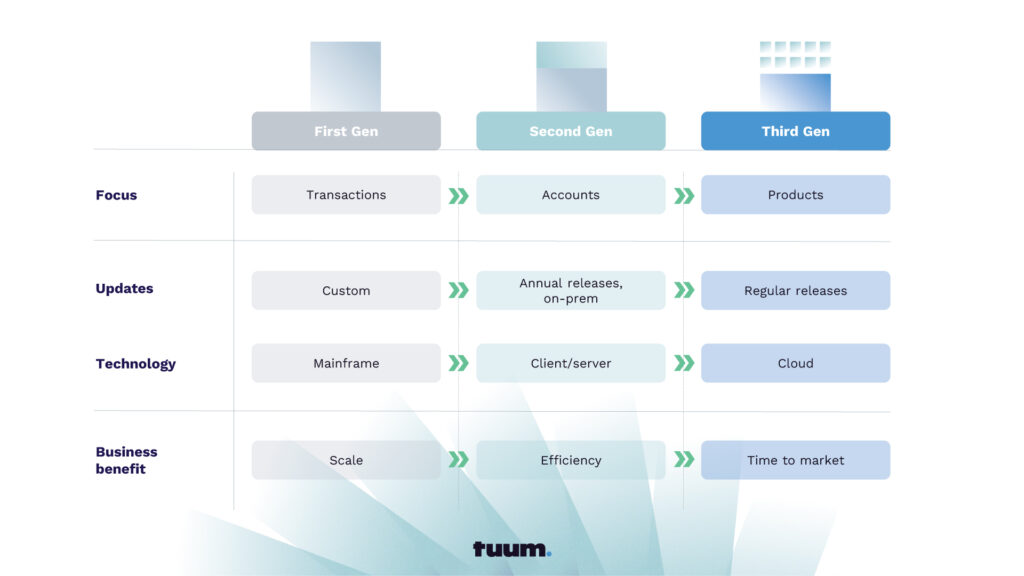

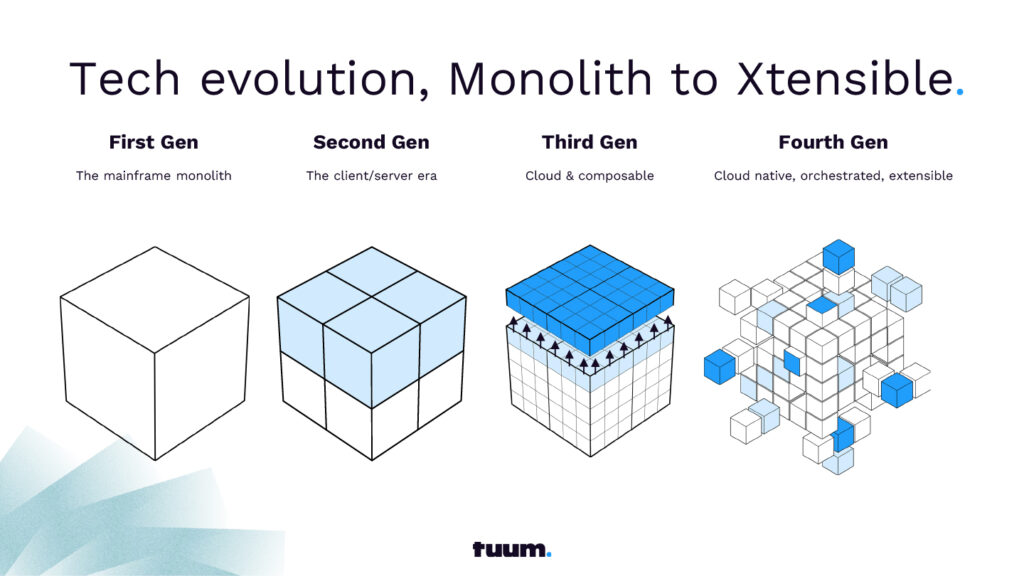

The evolution of core banking systems

The first generation of core banking systems were built on mainframe technology. They automated branch accounting tasks and processed updates in overnight batches.

With the client/server revolution, a new generation of systems emerged. These had graphical user interfaces, relational database structures that could be organised around products and clients, and, in later iterations, 24/7 processing.

The challenge for these second-generation systems has been coping with the increasing volumes of interactions and real-time nature of digital banking. As a consequence, banks started to adopt third-generation systems, deployed natively in the public cloud, which can be launched quickly, with better scalability, and lower costs.

Cloud-native core banking systems

Cloud-deployed core banking systems benefit from many advantages over on-premise installations, such as elastic scalability. However, the drawback compared to on-premise installations is the extent to which a bank can customize the solution to their needs.

Essentially, with the move to cloud there is a fundamental switch from the bank running and controlling its own system to the bank becoming a consumer of a service provided by a vendor. In this new paradigm, the bank is much more constrained in terms of what it can change and add to the service and, by extension, it becomes much more dependent on the vendor than in the past. If a bank wants an enhancement, it has to ask the vendor to add it to the roadmap and wait for it to be developed.

The trade-off at the heart of cloud-based systems

Relying on the SaaS core banking vendor for system changes is a major concern for many, especially larger, banks. While they welcome the quicker time to market and lower cost of ownership these systems bring, they worry about the dependence on vendors to roll-out mission critical changes in the face of fast-changing regulatory, competitive, consumer and technology landscape.

Some newer entrants have tried to solve for this constraint. They substitute a closed-box system (wholly controlled by the vendor) for an open-box system where the customer can develop as much custom code as they like. This allows the bank to add new features by themselves, using their own IT team, putting them in the driving seat to make the changes needed to adapt to market demands. However, this introduces a different trade-off. While the bank is free from the same vendor dependency, the cost of the core banking infrastructure mushrooms. The bank moves from consuming a software service, to having to build, test and launch products themselves and then maintain the code they write. Furthermore, a lot of redundancy gets introduced into the system over time because the banks building these new products end up copying and pasting the same pieces of code time and time again to launch different versions of existing products.

So, in summary, in the cloud era banks have faced the choice between, on the one hand, low cost of ownership with high vendor dependency and, on the other, high autonomy and high cost of ownership.

This is now changing.

Core banking. Without constraints.

The Tuum platform has been conceived from the beginning to remove many of the constraints that the market has faced with the existing core banking systems. For instance, the solution is cloud-native but also functionally rich (covering accounts, lending, payments and cards). It also delivers fast time-to-market with a best-of-breed ecosystem of partners. It offers a fast, predictable approach to legacy migrations. But as in pertinent to this discussion, it gives banks both high autonomy AND low cost of ownership.

How do we do this? In two ways, principally.

The first is through our “Business Builder” capabilities. These offer our clients a very broad range of fine-grained configuration tools, enabling each client to have a high level of autonomy within a closed-boxed set-up (“configuration without customization”). However, while these tools are more extensive than anything else on the market, this approach to configuration is not new.

What we realised is that we needed to go further. We needed to introduce a new concept, which we believe will be the defining characteristic of a new generation of core systems.

This concept is Xtensibility.

Introducing the Xtensible Core

Our starting point here was to go further than configuration. We asked ourselves, how do we create the means for a bank to change the system, but while leveraging the efficiency of the product builder capabilities, and without introducing the burden of managing the full software development life cycle on the changes it introduces?

Our answer and our vision is Xtensibility. Our aim is to unlock a new degree of flexibility while building financial products by offering:

- The ability to override the native product behaviour for certain features within a module (e.g. Lending, Accounts)

- The ability to define new custom attributes (data fields) to capture new data points related to a financial product

- Business logic (rules) that can refer to the native as well as the new custom attributes

- The ability, by extension, to extend or override the native product logic for certain features

In addition, Xtensibility can be applied beyond just the Tuum core system. Where the business logic necessary to change a product sits in an external system, this can be incorporated into the Tuum process orchestrator domain and the dependencies handled by calling the relevant Tuum APIs. This allows the Xtensibility concept to be deployed even for complex use cases like the interoperability of an existing (legacy) pricing engine with products configured in Tuum platform.

In the near future, we expect to be able to apply Xtensibility to use use cases including: interest calculations & accruals, pricing and fees application, tax calculation, limits and validations, and controls to manage the status or lifecycle of various business objects like collection strategies, receivable statuses etc.

Looking further ahead, we expect to include Xtensibility for use cases like product bundling where usage of one product influences the behaviour of another like discount pricing on loan for an existing customer with a savings product. In addition, we believe it will be applicable for self aware products that can manage their own lifecycle based on usage.g. extending credit to customers based on the transactional activity. This may involve integrations or deploying of new technologies like AI.

Xtensibility: a Goldilocks phenomenon

Xtensibility removes the trade-off that banks have faced with cloud native core systems.

With Xtensibility, our clients are able to extend the platform, adding to or overriding product logic based on their specific needs, including conforming to local market rules, through the use of custom parameters. Effectively, our customers can build their own IP, but within given constraints, posing no risk to upgradability and allowing all code to be governed within Tuum’s testing and deployment cycles.

It enables customers to launch products quickly without waiting for any requisite feature to be included in a new core release but, critically, without any coding, testing or maintenance on their part. And their core system, notwithstanding the IP they’ve added, will be continually upgraded through regular releases.

Xtensibility is like a Goldilocks phenomenon: enough freedom for clients to adapt our system so that they can respond quickly to changing market needs, but not too much freedom that they introduce high costs and redundancy into the system.

Adapt. Expand. Extend.

This new Xtensibility framework sits neatly within our customer proposition.

Extensive business builder capabilities allow our customers to configure the rich functionality within our system, adapting it to suit the specific needs of their operating, sourcing and distribution models.

The functionality and services of our system can then be expanded seamlessly through our partner ecosystem, specifically through the blueprints we set out for different client archetypes and use cases.

And then, uniquely and radically, our clients will be able to extend the solution, adding their own product logic to cater for the cases that can’t be met through configuration or complementary software, but without creating an onerous software development burden.

Our mantra thus becomes Adapt. Expand. Extend.