By: Tom Phillips – Sales Director, Tuum

Woe betides the salesperson that calls any building society a bank.

They won’t make the same mistake twice. Believe me.

Building societies are not banks.

The difference as any society will tell you is their mutual ownership.

Owned by their members. The customers that have accounts, deposits and mortgages with them. As such societies benefit from an unrivalled level of customer satisfaction and importantly, trust.

95% of building society members surveyed by the Building Societies Association would attest to receiving a good level of customer service. Trust amongst society members was 88%. This eclipses not just relationships with their banks but also the likes of Google, Amazon and even their own doctors!

Facebook managed only 5%. Poor Zuck.

This is where FinTech has struggled to truly disrupt. Despite cool features, low friction and neon coloured debit cards, neo banks haven’t been able to build trust like a building society.

So, what would happen then if a building society delivered something more like a neo bank?

A modern technology strategy could see societies hurdle challengers in their race for trust-based relationships.

A market of impact as well as scale

Besides trust the building society segment also has impressive scale.

27million members in the UK bank with one of the 43 building societies and seven larger credit unions. Compared to a total 20million customers of UK challenger banks.

More than just the number is the societal good that mutuals deliver.

They enable home ownership country wide, getting more first time-buyers on the property ladder. They support members with their finances through cost-of-living pressures. They support communities locally through charitable activities.

Having a meaningful impact is heart to their business model. In a new world of Environmental, Social and Governance (ESG) focus societies are industry leaders.

A changing environment

Despite a sizeable market of loyal customers, a proven business model and clear impact message societies can expect head winds.

We have witnessed the shift to Millennials and Generation-Z becoming the dominant consumers. With a traditional model and aging member base, it could be argued this shift and the change in customer demand for digital will impact societies hardest.

An estimated £1trillion of assets is predicted to move hands to a younger generation before the end of 2027. This is going to mean a more competitive savings market.

Without offering Current Accounts (ex. Nationwide Building Society and Cumberland Building Society) building societies will either have to continue to offer higher rates or provide an enhanced service offering to attract balances.

The need to have a strong digital capability is no longer an opportunity, it’s a must have.

I’m the new target market

Allow me to demonstrate.

Despite the greying hair I am in the Millennial to Generation-Z bucket. Apparently, I am the new target demographic.

This makes sense. I’m at a point in life where I want to invest safely. I have a young child and a family. I want to put some of my income away for the long term. Savings for school fees, the house, and if there’s any left maybe a new car.

But when I look at my banking relationships, I’ve not considered a building society.

I have strong trust in building societies. My first account as a child was with the Halifax. Nationwide gave me my first mortgage. I value the impact and their focus on societal good.

But if there’s an ounce of friction in the journey, any clunk in the user experience, if I can’t have instant access to money movement or my data, then I’m out.

My savings sit with Chase‘s challenger bank. Any society would have to deliver a digital and user experience surpassing that to convince me to move.

Current state of the segment

So where are societies working to modernise?

Building societies are a business of two halves and I picture their technology stacks to mirror this.

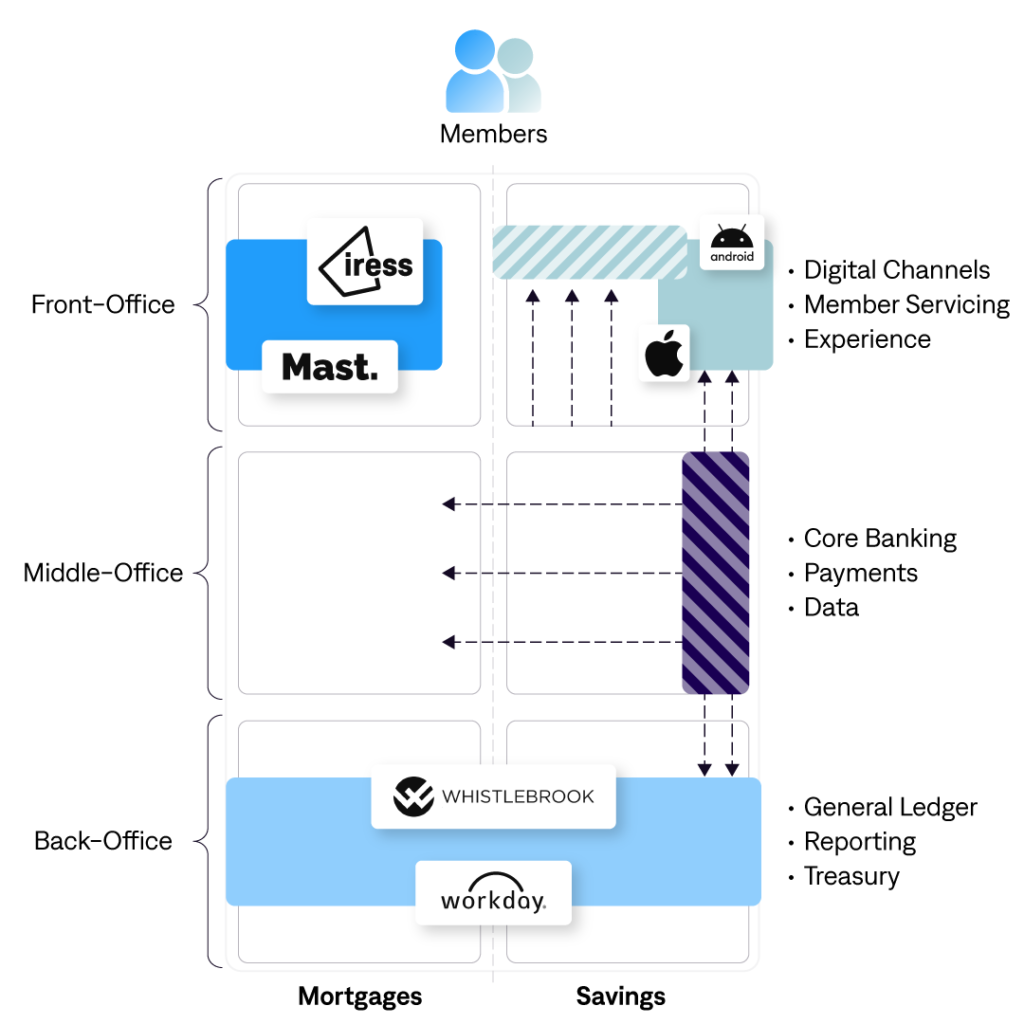

For simplicity imagine six boxes (see below).

At the top there are the front-office systems. Customer facing channels, business processes like account opening and servicing. In the middle are the middle-office systems. Core banking, payments, data services and other enterprise platforms. At the bottom are the back-office systems. Finance, reporting, ledger, HR and controls services.

Three boxes on the left supporting savings, and three on the right supporting residential lending.

Hope you’re still with me.

For the larger societies of £1.5billion assets and above a targeted approach to modernisation is already underway.

At the bottom of our diagram, in the societies back-office many are going through enterprise modernisation of finance platforms. They have partnered with global platforms like Workday or more specialist services like Whistlebrook Ltd to deliver efficiencies in regulatory reporting, performance and risk management.

At the top left of the diagram, the the mortgage front-office many are on a journey to modernise digital origination through broker channels. Partnering with Mast and Iress to improve application times and reduce friction in the process.

This makes sense.

The Building Societies Act 1986 (Amendment) Bill that passed January of this year will help mutuals compete better with banks. It will support them to lend more money in a safe and secure way.

It makes sense that broker channel modernisation is a priority to support more lending. These are atypical customer needs though and a modern broker channel will be unlikely to drive wider digital adoption to benefit members as a whole.

On the other side, top-right, digital savings journeys and mobile applications have been developed but with varying degrees of sophistication and success.

What about the middle

The middle of our diagram is the issue. The core banking system, the payments and other enterprise systems are mostly the same story as it was 10+ years ago.

Historically this layer has been a single platform from a single provider. These players have dominated the market but have not necessarily innovated like the newer breed of platform providers.

Smaller societies, below £1.5billion assets have been replacing this layer with another all-in-one provider. Looking to minimise technology resourcing internally and solve for all the product complexities that have been developed in the legacy system.

Whilst outsourcing the issue somewhat and reducing internal effort this approach increases the risk. It forces societies to tackle a full platform-to-platform migration.

In order to compete, societies need modernise this middle layer, but modern core platforms now offer a different approach.

Make a start with disrupting digital savings

Of the two sides of the business the lowest risk, highest impact starting point is savings.

The train of thought across larger financial organisations is no longer to replace the existing core system ‘big bang’ approach, but rather to augment them.

Building something narrow and deep. From a new digital application through to the modern finance platform. Proving out a targeted use case and then iterating quickly. Moving members and products across as you go.

This gives the society a number of options for vertical or horizontal modernisation. Either move up and build a new member experience capability on top of the new platform. Or move sideways to replace the entire savings estate before expanding into mortgages.

Disrupting savings isn’t just about disrupting savings

Replacing the savings platform shouldn’t just be about replacing legacy products and capabilities like-for-like. A new platform can be an enabler to test and execute on a member-centric strategy.

There are the obvious opportunities to deliver new, configurable and personalised products. Giving the society the ability to onboard a new customer in minutes. Launch a customisable tier-based deposit. Deliver relationship-based accounts for child savers. Gamify savings with easy-access pots, rewards, and notifications.

There are also the opportunities to use savings modernisation as a pathway to develop wider capabilities that align with the purpose of a mutual.

- Real-time payments – developing a thin use case for a modern core system allows societies a wedge to also develop a modern payment capability. Pre-integrated with a modern Payment Service Provider the legacy rails can be bypassed to deliver real-time money movements behind a modern user experience.

- Member Data – modern platforms with the benefit of elastic cloud storage will enable societies to analyse and provide the type of insight that is already common place amongst challengers. Developing data strategies here could be used to also transform lending and future state offerings for members.

- Open Banking/Open Finance – augmenting the data collected internally with readily available Open Finance data will allow societies to deliver a ‘360 Degree View’. Truly capturing financial health and enabling new solutions for finance management, catching a member before they call in to distress and proactively support day-to-day expenses.

- Generative Artificial Intelligence (GenAI) – that’s not as big a leap as you may think. Last month I wrote on the application of GenAI for finance and pictured building societies as the best candidate. The power lies in delivering human-like advice to consumers. As physical locations retreat couldn’t this be an alternative to support members?

There’s also something else.

Delivering something new will allow societies to invest in building small digital-native teams in-house. These technology teams don’t need to be large scale development shops. They can grow over time. But by building these teams the society will be more informed when buying and partnering with platform providers. They will be the teams that know how to orchestrate capabilities and connect platforms to deliver the societal good through technology.

Making the society less reliant on expensive external resource.

Building confidence for the rest of the business.

But what about Passbooks

For the rest of the Millennial to Generation-Z bucket you’ll have to Google what a Passbook is.

You can’t talk about technology modernisation within a society without addressing them.

Becoming more digital doesn’t mean doing away with the physical channels and physical products that are central to the identity of building societies. Developing digital and maintaining a physical presence don’t have to be mutually exclusive strategies.

Digital needs to be brought into the branch.

Bricks and mortar locations aren’t about teller machines and kiosks. It’s the human support and customer service.

The same digital capabilities and API-native platforms that deliver an iOS mobile application could be accessed via a building society colleague using an iPad in branch. Modern alternative branch technology like OneBanx can transform coffee shops and community centres in to service locations.

By developing an omni-channel strategy the Passbook becomes yet another way for a member to interact and manage their underlying data.

Perhaps someone from the societies new in-house digital-native team might create something more innovative that does the same job.

It’s about time a society digitalised the Passbook.

The mutual’s argument for change

Like our salesperson was reminded, building societies are not banks.

The difference as any society will tell you is their mutual ownership.

The downside of being a mutual when it comes to investment in change, is being a mutual. Diverting funds away from member services for special projects like transformation can be difficult.

Bank shareholders see the long-term value in technology investment. They have developed the view that innovation is a requirement to effectively compete in financial services. Boards are happy to sign off on multi-year project costs in the hope that it will return future equity.

The truth is 70% of digital transformations fail so a project that doesn’t have immediate benefit to existing members is a tough sell for building society leaders.

That’s why starting narrow with a modular core is sensible and should be an easier sell to the board.

A thin use case that aligns with the societies mutual purpose and delivers value in 6 months should drive that home.

Reduce risk, minimise costs, and build confidence in the societies own ability to disrupt.

Get in touch to find out more.