Global pandemic showed that legacy systems must go

The recent global pandemic has made it clearer than ever – there is no place for legacy systems. And those who want to survive and thrive need to act fast and remain flexible.

Amidst the COVID-19 crisis, the Finnish Ministry of Justice proposed a new legislation to halve the maximum interest rate on consumer loans. It’s now capped at 10%, compared to its previous 20% cap. The ruling applies to all loan contracts with withdrawals made between May 1 and December 31 of this year.

This creates a situation where a loan contract has:

- an original interest rate for withdrawals before May 1

- an altered rate of 10% for withdrawals in the period between May 1 and December 31

- an original interest rate for withdrawal after December 31

The interest rate changes have to be taken into account when calculating the repayments according to the client withdrawals. And for a bank, this calls for flexibility in their system to change interest rates and adjust repayment schedules.

It may sound like a small change, but for banks running on legacy monoliths, this comes with sizable costs and huge amounts of time lost. Legacy systems are inflexible, testing is painstakingly long, and many were written so long ago, it’s difficult to find people who understand the systems. Imagine a system still running on COBOL…

In this scenario, technology becomes a major roadblock. While the customer is the focal point of this conversation, the solution on how to actually serve them best comes down to technology. None of this is news to neobanks. However, the incumbents who grasp the endless opportunities modern core technology architecture can offer will come out at the top.

Now, imagine this scenario with a modern banking platform. It’s pretty straightforward. With Tuum, it would mean changing the interest rate through a simple product configuration.

And if there is a need to change thousands of contracts, this can be done over APIs.

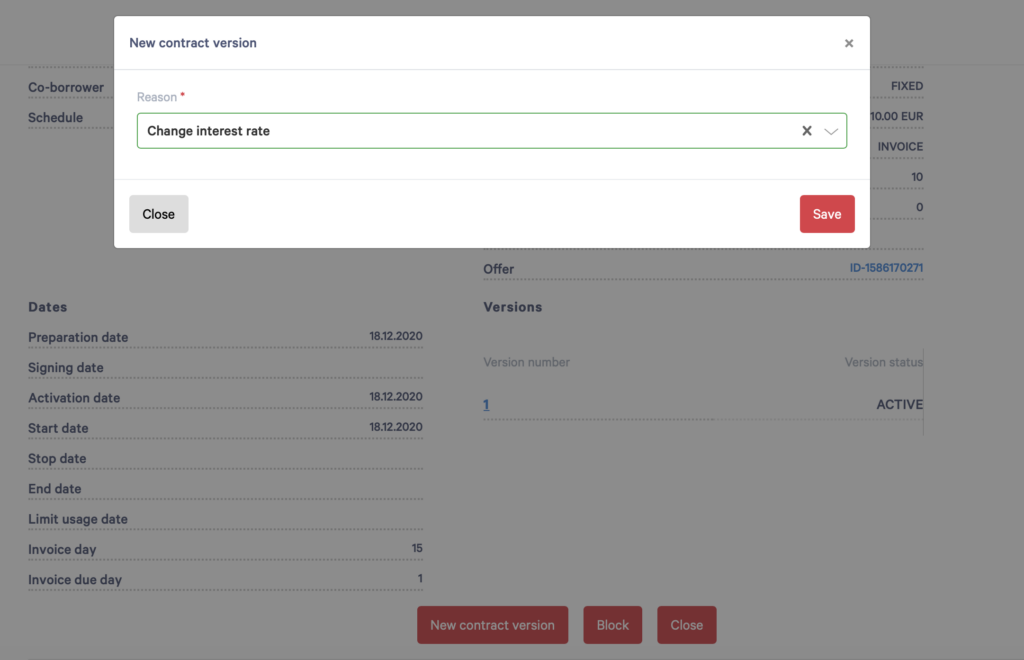

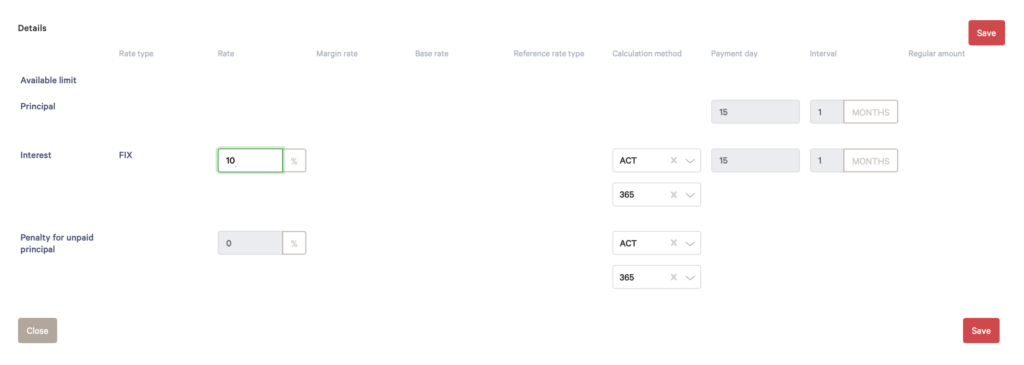

Making the actual change in the interest rate

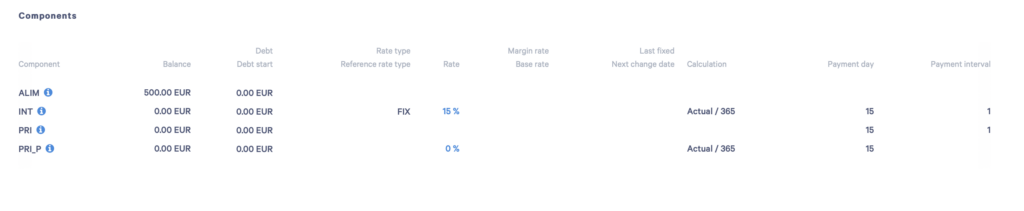

Before

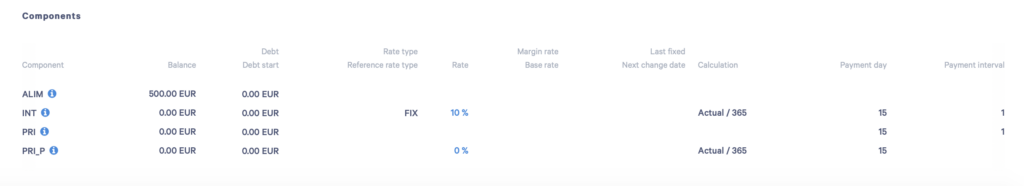

After

When it comes to repayments, all the calculations are done according to the new rules automatically. The part that poses a headache to established institutions needn’t take longer than a few minutes.

Replacing legacy systems

According to a McKinsey survey in 2019, although few incumbents were investing in innovation, the worry about the limitations of their core systems (and the slow pace of change) was clearly present. 70% were reviewing their core systems. But, it’s taken the COVID-19 crisis to expose on a large scale quite how vulnerable legacy systems really are.

Financial institutions find themselves at the forefront of the crisis: they need to react quickly to their customers’ changing circumstances (e.g. application processing and payment holiday requests), respond to government regulations and act as tools in government crisis alleviation plans.

In reality, incumbent institutions running on legacy systems simply aren’t up for the task. British Business Bank, a state-owned development bank administering the government’s Coronavirus Business Interruption Loan Scheme, has already brought in challenger banks as time is of the essence here. Meanwhile, customers are spending hours on the phone to request payment holidays with banks struggling to respond to their requests as they crumble under manual work.

Digitalisation of the industry will continue at full speed. This crisis has made the need for it clearer than ever. In fact, it’s a bit of a now or never moment in the industry: it’s evident that the ones coming out of this are the ones that can move fast, remain flexible and cater to their customers’ unique needs, in both services and channels.

About Tuum

Tuum is developed to give maximum flexibility to companies interested in offering tailored financial services to their clients. This is what we provide:

- A cloud-native and API-first platform for automatisation that improves efficiencies and results in cut costs. The APIs provide easy integration and ecosystem building with best-of-breed solutions on the market.

- Ecosystem building. We create a partnership network to provide a comprehensive service to our clients. This allows our clients to scale and innovate by connecting with the best solutions on the market.

- Microservice-based modular architecture. The banking suite can be implemented whole or clients can pick and choose only modules relevant to them. Same applies to the ecosystem where adding and changing providers is easy.

- Flexible configuration capabilities. This means instant personalisation of products and services, meaning faster reaction time to situations and quick time to market.